Repeatedly calculate the EMA for them and add them to our EMA list. Now we need to loop through the numbers that are not in the range of the day length constant and def calculate_ema( prices, days, smoothing= 2):Įma = ) / days] # First method #Įma.append( sum(prices) / days) # Second method There are two simple ways we can go about this. Remember that the first step to calculating the EMA of a set of number is to find the SMA of theįirst numbers in the day length constant.

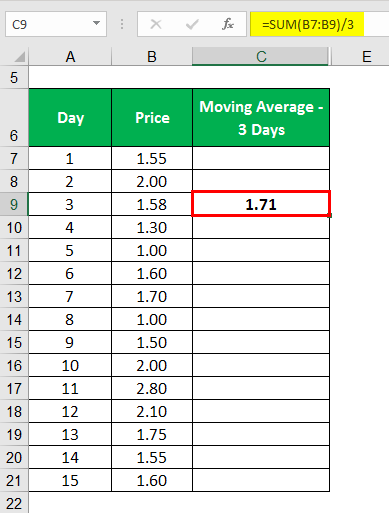

We will then consider the 10 day SMA toīe our first EMA value. Will first calculate the SMA of the first 10 stock prices. Step to calculating EMA is to actually calculate the SMA of the day length constant. In Step 2, we established that we would be calculating EMA for every 10 day observations. One is a 10-day period and that is what we will be using. Traders use various day lengths when calculating EMA, but a common The smoothing factor can be altered upon preference, but a common choice for this variable is 2 and Is that EMA responds faster to upward price movement compared to SMA. The essential difference between EMA and SMA Greater weight or importance to previous stock prices.

EMA is a type of moving average indicator that gives Giving you a brief overview of what it is.

Understanding Exponential Moving AverageĪlthough I won't be going too deep into the concept of EMA (Exponential Moving Average), I will be

Ema formula install#

The modules that we will be needing are listed below and you can simply install them withĪ pip3 install. In this article, I will be showing you how you can calculate the Exponential Moving Average of a

0 kommentar(er)

0 kommentar(er)